There are many things and options to consider when thinking about purchasing a house. Save for the downpayment, locate a house in a great school district, and check that the house is in good repair. It's also important to consider the local culture and small businesses. Last, ensure you can afford the mortgage payment. You don't want to purchase a home that is too costly.

A down payment? Save your money

If you're saving for a down payment on a new home, the best place to keep it is an FDIC-insured savings account. These accounts have higher than average interest rates and are easy to access. For those who are planning to buy a long-term home, it may be more practical to invest in the market. The potential for higher returns can make sense.

Start by calculating the income. Start by calculating your monthly income and adding in the income of your spouse if you have one. Look at your bank statements and credit card bills.

A house in a desirable school district is a must

A family's decision to buy a house is often influenced by the proximity of schools. But, quality is not the only factor that matters. It is also important to consider factors like commute time and school quality. It is important to consider all these factors and to be open to making sacrifices or giving up some features.

First, buying a house for yourself, or for your family, in a good school area will increase its resale price and make it easier for you to sell. If you're thinking about buying a home for your children, it is important to choose a school district that offers the best education. Some school districts also have special provisions for children with special needs.

A home inspection

A home inspection is essential before buying a house. It will give you a sense ownership and will help you negotiate the selling price. A well-maintained home will usually be worth closing on. But, if the property is in dire need of work, an inspector's report may help you to negotiate a price or convince the seller that the problem can be fixed.

A home inspection that reveals serious problems such as a leaky heater or other issues could allow you to negotiate with the seller to reduce the price or make repairs. If you aren't willing to pay for repairs, you can walk away from the agreement. Many sellers agree to conduct a home inspection as part their sales contract.

FAQ

Can I get another mortgage?

Yes. However, it's best to speak with a professional before you decide whether to apply for one. A second mortgage is typically used to consolidate existing debts or to fund home improvements.

What are the most important aspects of buying a house?

The three most important factors when buying any type of home are location, price, and size. It refers specifically to where you wish to live. The price refers to the amount you are willing to pay for the property. Size refers to the space that you need.

How long does it take to get a mortgage approved?

It depends on several factors such as credit score, income level, type of loan, etc. It generally takes about 30 days to get your mortgage approved.

How much will it cost to replace windows

Replacing windows costs between $1,500-$3,000 per window. The cost of replacing all your windows will vary depending upon the size, style and manufacturer of windows.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

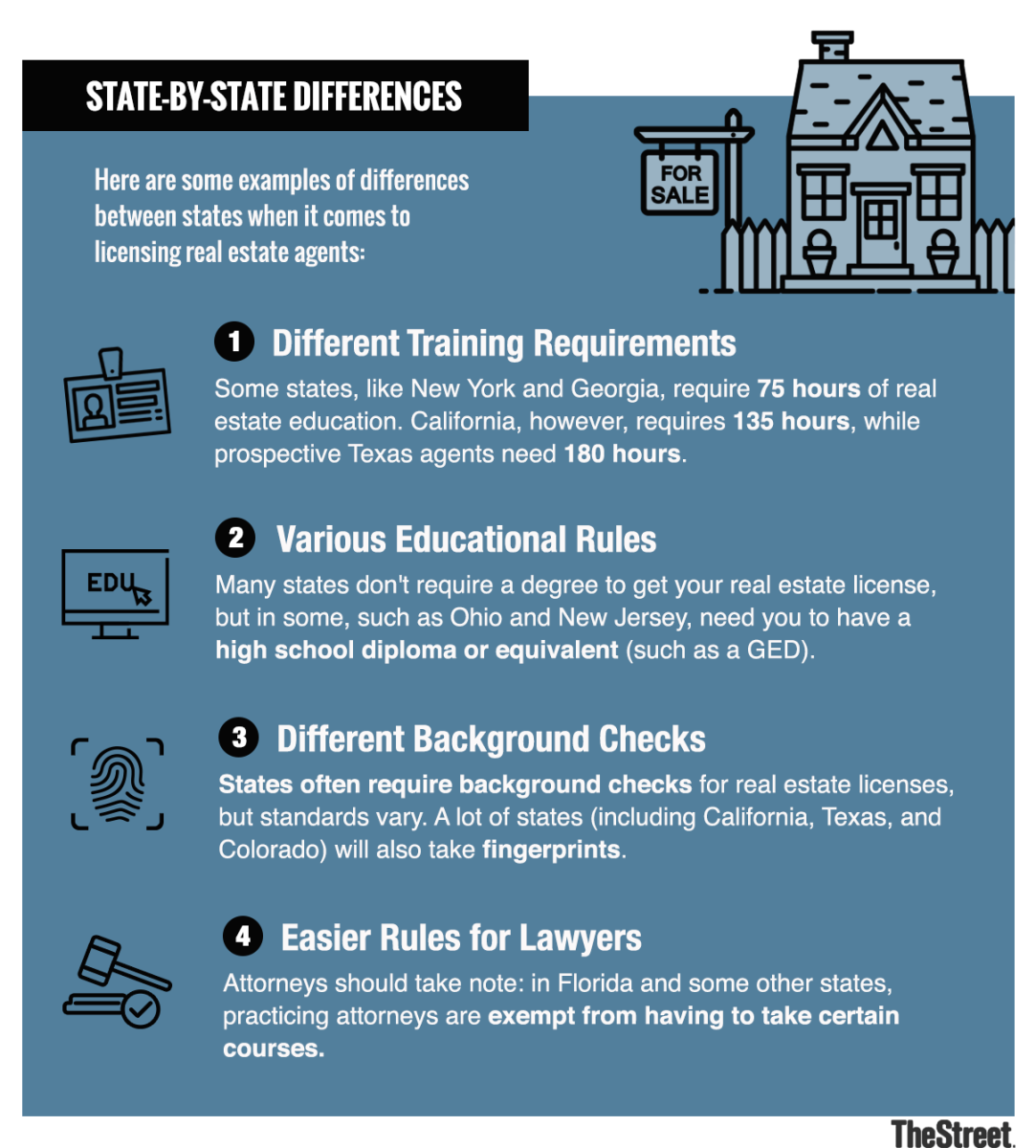

How to become a real estate broker

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This requires you to study for at least two hours per day for a period of three months.

After passing the exam, you can take the final one. To become a realty agent, you must score at minimum 80%.

All these exams must be passed before you can become a licensed real estate agent.