Real estate agents need to know how to analyze the value of a property using a comparative marketing analysis (CMA). This can ensure that the property is accurately priced and is priced in a manner that suits the seller or buyer's needs.

CMAs help sellers to determine the best selling price for their properties and buyers to make fair offers that are reasonable without being too aggressive. A good agent can conduct a CMA to help their client sell or buy a home faster and at better prices.

How to do a CMA

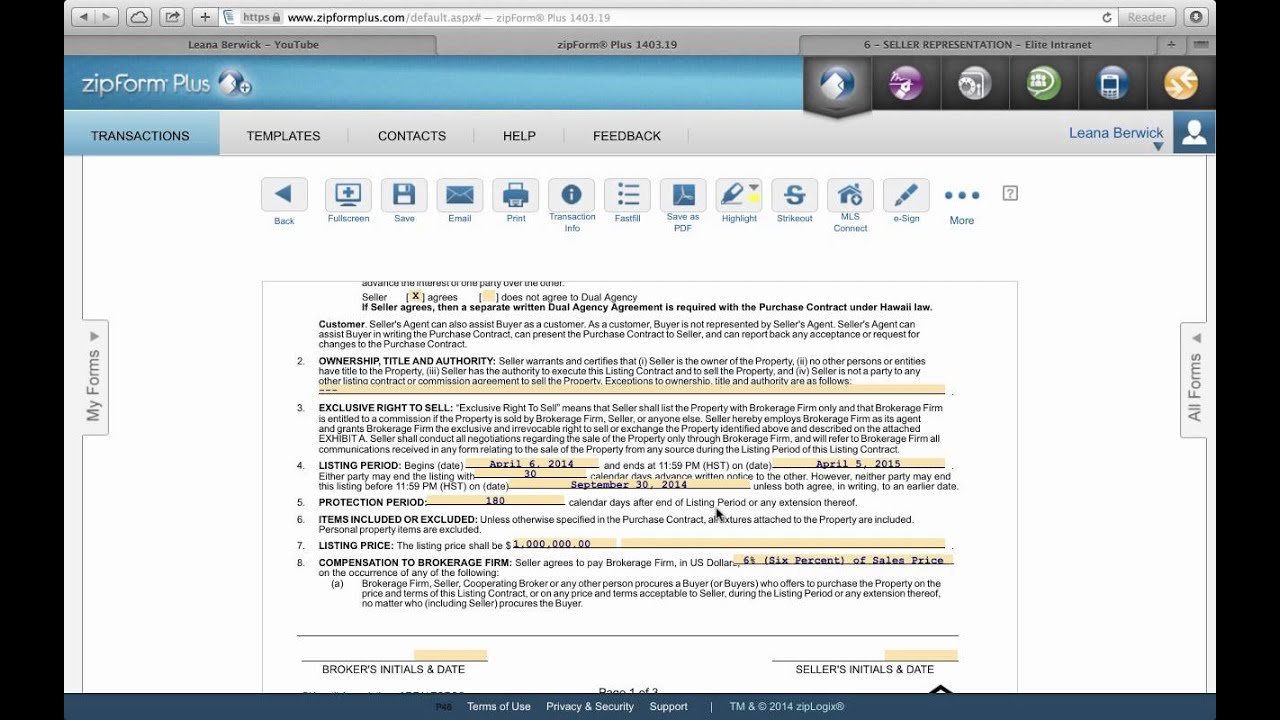

Locating comparable sales is the first step in creating an CMA. You can search the MLS or other real estate websites to find comparable sales. CMAs require that properties be identical in many ways.

After the properties are compared, marketability must be assessed. This is done by looking at their selling price and the time it took for them to sell. It is important to adjust for the differences in the square footage and bedrooms as well as key features, lot size, age and condition of comparable properties.

Next, the agent will collect information about each property. The information includes the address, square footage and number of bedrooms and baths, as well as construction type and special features. It is also helpful for you to get information about the property's taxes and other factors that could impact its value.

During a walk-through of the property, the real estate agent will take detailed notes about all of the aspects of the home. This is a crucial step in completing the CMA, as these notes will be incorporated into the final CMA report.

After the visit, the real estate agent will compile a list of comparable properties that are most similar to the subject property. This list will include both homes that have been sold and those still pending. The agent will then look at each of the properties and compare it to the subject property.

The agent will then use reconciliation to determine correct offer prices. The process involves comparing all three comps and assigning weights to each one based on the adjustments. The agent will then use this weight to calculate the ideal offer price.

Although it may look similar to an appraisal in some ways, a CMA will not be considered an appraisal. A CMA is not an appraisal. It is a thorough evaluation of a property by licensed real estate appraisers. It is not intended for replacement of an appraisal.

A CMA is an effective method for determining the worth of a home, but it is not always accurate. Selling agents should be qualified to handle the CMA. Agents will make sure that the CMA is correctly prepared and is based upon market data.

FAQ

What are the drawbacks of a fixed rate mortgage?

Fixed-rate loans have higher initial fees than adjustable-rate ones. You may also lose a lot if your house is sold before the term ends.

How many times do I have to refinance my loan?

It all depends on whether your mortgage broker or another lender is involved in the refinance. You can refinance in either of these cases once every five-year.

Is it possible sell a house quickly?

If you have plans to move quickly, it might be possible for your house to be sold quickly. But there are some important things you need to know before selling your house. You must first find a buyer to negotiate a contract. The second step is to prepare your house for selling. Third, advertise your property. Finally, you need to accept offers made to you.

How much will it cost to replace windows

Windows replacement can be as expensive as $1,500-$3,000 each. The cost to replace all your windows depends on their size, style and brand.

How do I calculate my interest rate?

Interest rates change daily based on market conditions. In the last week, the average interest rate was 4.39%. The interest rate is calculated by multiplying the amount of time you are financing with the interest rate. For example, if you finance $200,000 over 20 years at 5% per year, your interest rate is 0.05 x 20 1%, which equals ten basis points.

How much money should I save before buying a house?

It depends on how much time you intend to stay there. It is important to start saving as soon as you can if you intend to stay there for more than five years. But if you are planning to move after just two years, then you don't have to worry too much about it.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

How to Find an Apartment

When moving to a new area, the first step is finding an apartment. This involves planning and research. This involves researching and planning for the best neighborhood. There are many ways to do this, but some are easier than others. Before renting an apartment, it is important to consider the following.

-

You can gather data offline as well as online to research your neighborhood. Online resources include Yelp. Zillow. Trulia. Realtor.com. Offline sources include local newspapers, real estate agents, landlords, friends, neighbors, and social media.

-

Read reviews of the area you want to live in. Yelp. TripAdvisor. Amazon.com all have detailed reviews on houses and apartments. You might also be able to read local newspaper articles or visit your local library.

-

To get more information on the area, call people who have lived in it. Ask them what they loved and disliked about the area. Ask if they have any suggestions for great places to live.

-

Be aware of the rent rates in the areas where you are most interested. You might consider renting somewhere more affordable if you anticipate spending most of your money on food. However, if you intend to spend a lot of money on entertainment then it might be worth considering living in a more costly location.

-

Find out more information about the apartment building you want to live in. How big is the apartment complex? How much does it cost? Is the facility pet-friendly? What amenities does it have? Are there parking restrictions? Do tenants have to follow any rules?