If you're wondering, "How much does a real estate agent make?" there are a few things you should know. The income of real estate agents is comprised of income taxes in NYC, commissions and expenses. Then you can calculate a realistic Salary range. Here are some top ways to work out the monthly costs and commissions.

Commissions

The number of houses an agent sells determines the commissions. The real estate company assigns a computer program to calculate commissions for each real estate agent. Each property that sells in a given month is paid separately to the realty agent. There are three types of houses in a real estate company. Each has a unique description and a different commission rate. For example, in the United States the average commission for an agent selling real estate is three percent.

Expenses

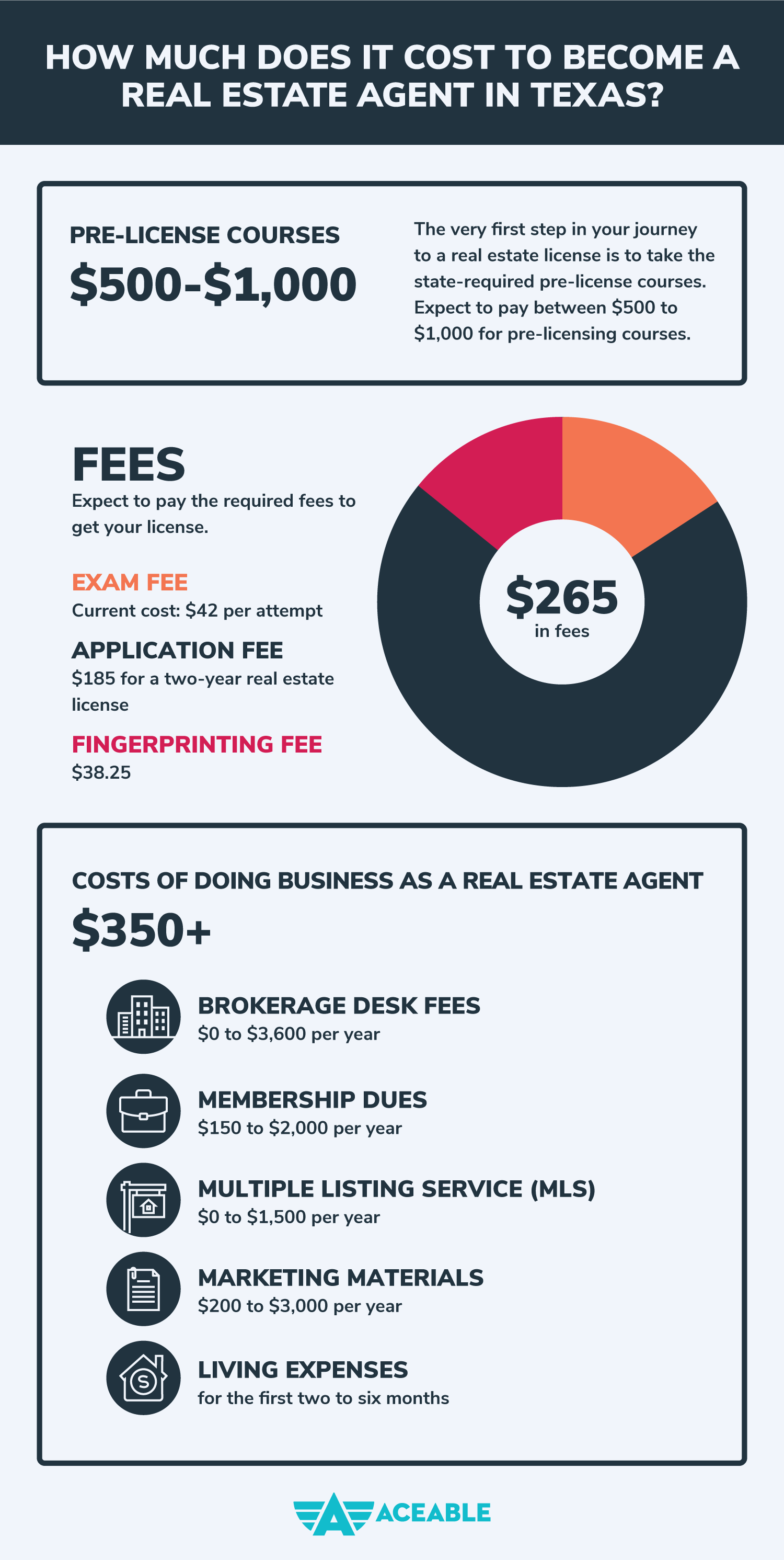

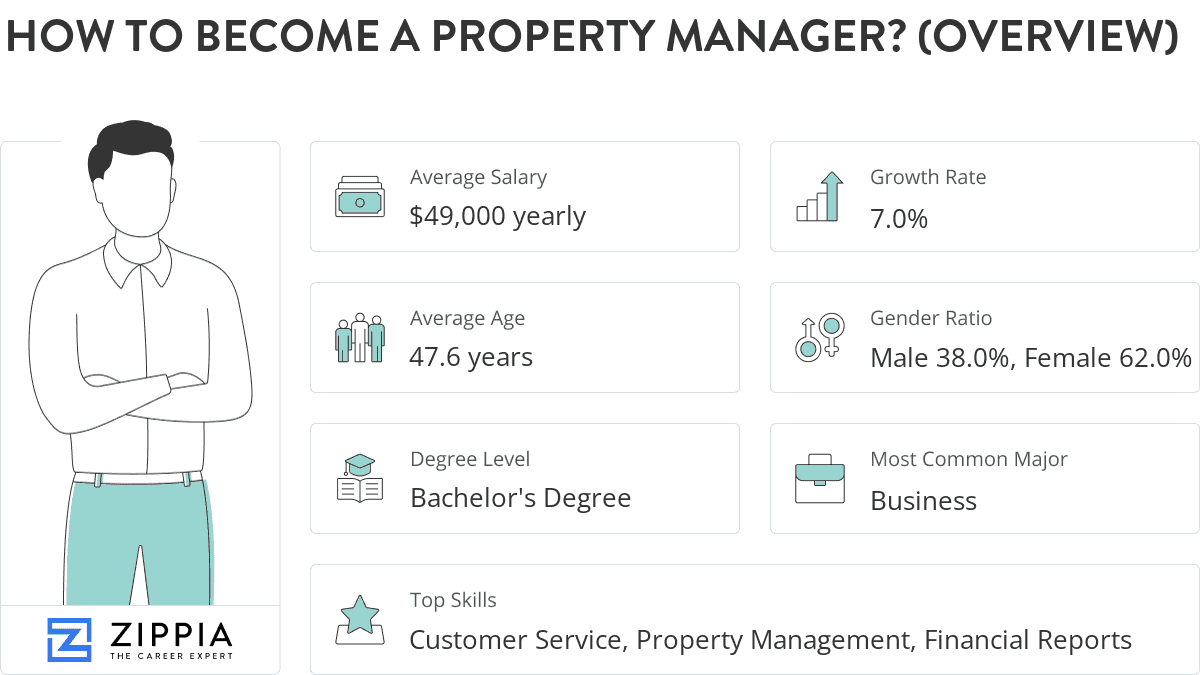

An average real estate agent's annual salary in the United States of $49,000 This amount varies depending on where an agent is working and what market they are in. In addition to federal taxes, real estate agents must pay an additional 20 percent in overhead and expenses. However, real estate agents earn an average annual $49,000 while those with the highest incomes make more than $112,000 annually.

NYC income tax

The type of property sold will determine the amount of commission an agent receives. An apartment with 2 bedrooms will run you around $2500 per month in NYC. This represents 21.4% the agent’s take-home wage. New York City has a cost of living of approximately $1250 per person per month and $4,592 per family of four. These costs add up and can be a significant expense for agents in real estate.

Salary range

An Austin real estate agent can expect to make an average of $88,996 annually, which is 13% more than the national median. Austin is an incredibly growing city and experienced rapid growth several years ago, thanks to its booming tech industry. The current population stands at just over one million. An Austin real estate agent should expect to sell everything from single-family homes to downtown condos.

Spheres of influence

Your sphere or circle of influence is the network of people that you know well. It could include your long-term clients or family members. It means that you can influence someone's buying or selling decision. How can influence be built? The following are four ways to build influence. Let's explore each. Learn how to leverage your network to get referrals and business. Sphere of influence: How to build a long-term referral business.

FAQ

How much money do I need to purchase my home?

The number of days your home has been on market and its condition can have an impact on how much it sells. Zillow.com shows that the average home sells for $203,000 in the US. This

How can you tell if your house is worth selling?

You may have an asking price too low because your home was not priced correctly. A home that is priced well below its market value may not attract enough buyers. To learn more about current market conditions, you can download our free Home Value Report.

What are the chances of me getting a second mortgage.

Yes. However it is best to seek the advice of a professional to determine if you should apply. A second mortgage is usually used to consolidate existing debts and to finance home improvements.

What should you consider when investing in real estate?

You must first ensure you have enough funds to invest in property. You will need to borrow money from a bank if you don’t have enough cash. It is also important to ensure that you do not get into debt. You may find yourself in defaulting on your loan.

You also need to make sure that you know how much you can spend on an investment property each month. This amount should cover all costs associated with the property, such as mortgage payments and insurance.

It is important to ensure safety in the area you are looking at purchasing an investment property. It would be best if you lived elsewhere while looking at properties.

Statistics

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

External Links

How To

How to Find an Apartment

Moving to a new place is only the beginning. Planning and research are necessary for this process. It involves research and planning, as well as researching neighborhoods and reading reviews. While there are many options, some methods are easier than others. The following steps should be considered before renting an apartment.

-

Data can be collected offline or online for research into neighborhoods. Online resources include Yelp. Zillow. Trulia. Realtor.com. Local newspapers, landlords or friends of neighbors are some other offline sources.

-

See reviews about the place you are interested in moving to. Yelp and TripAdvisor review houses. Amazon and Amazon also have detailed reviews. You might also be able to read local newspaper articles or visit your local library.

-

Make phone calls to get additional information about the area and talk to people who have lived there. Ask them about what they liked or didn't like about the area. Ask for their recommendations for places to live.

-

Be aware of the rent rates in the areas where you are most interested. If you think you'll spend most of your money on food, consider renting somewhere cheaper. However, if you intend to spend a lot of money on entertainment then it might be worth considering living in a more costly location.

-

Find out information about the apartment block you would like to move into. Is it large? What's the price? Is it pet friendly What amenities are there? Can you park near it or do you need to have parking? Are there any rules for tenants?